Payday Super Commences Soon, Ensure Your Business Is Ready!

by Luke Quinnell Payday Super will commence on 1 July 2026. This is one of the most significant changes to payroll compliance in many years. If you pay employees, you must ensure your business is fully prepared well before the deadline. Payday Super Requirements For Employers These new laws require all employers to pay Superannuation […]

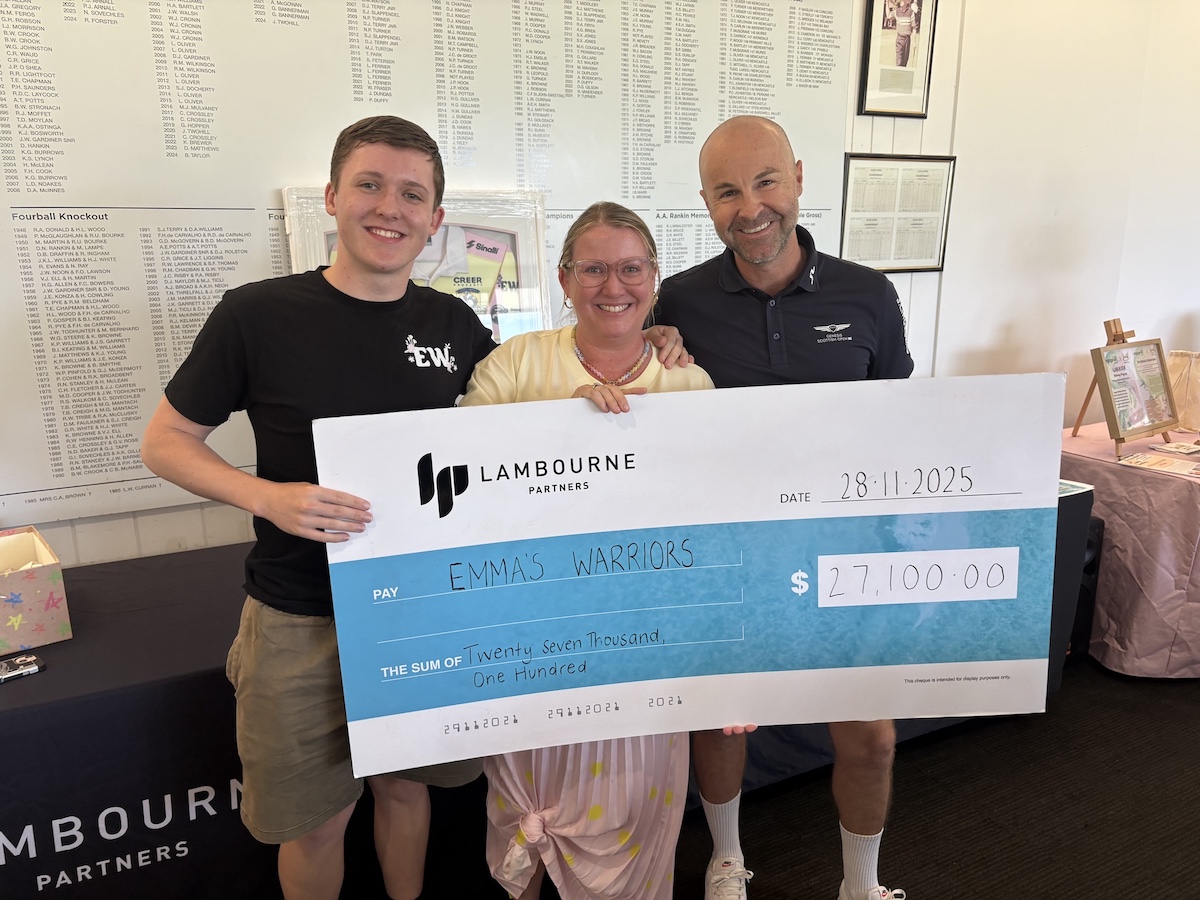

READ MORE2025 Lambourne Partners Annual Charity Golf Day

On Friday the 28th of November, we held the 14th annual Lambourne Partners Charity Golf Day at the Newcastle Golf Club. The event has raised $240,000 for local charities since 2011. This year our selected charity was Emmas Warriors. Emma’s Warriors is dedicated to making life a little easier for children and families undergoing treatment […]

READ MOREUpdate On How Holiday Homes Are Treated For Tax Purposes

by Luke Quinnell Owning a holiday home that’s rented part-time and used personally offers flexibility and potential taxation benefits. Rental income can offset ownership costs, and legitimate deductions—such as interest, rates, and maintenance—may apply for income-producing periods. However, the ATO closely scrutinises these arrangements because mixed use often leads to inflated or incorrectly apportioned claims. […]

READ MORE