by Tony Carter

by Tony Carter

Whether it be a family law property settlement or a business purchase, it is important that the negotiating parties are aware of what is and is not to be included in the transaction.

Before negotiating value of the assets, the parties should have a clear understanding of what assets are on the table in the first place.

I often hear the terms “value of my business” and the “value of my company” used interchangeably when in fact they mean quite different things for different people. This is where the concepts of Enterprise Value vs Equity Value are useful in avoiding misunderstandings.

Enterprise Valuation

The “value of your business” is the Enterprise Value and is made up of all the things required to carry on your business – no more and no less.

These things are typically the:

- Net working capital (e.g. stock, debtors less operating liabilities)

- Goodwill

- Plant and equipment.

An Enterprise Valuation is most often used when buying or selling a small business, as the incoming business owner is only interested in acquiring the unencumbered assets that they need to run the business in the same way the outgoing owner did. They typically have no interest in acquiring any assets surplus to business operations, and they almost certainly have no interest in assuming responsibility for any of the liabilities.

Equity Valuation

When the business is larger and more complex, or the parties are discussing net wealth (as is the case in family law property settlements), it is more relevant to discuss the “the value of the company” and this is where an Equity Valuation tends to be more useful.

An equity valuation considers all the assets of the company whether they are used in the business or not, and includes all the enterprise assets plus any Surplus Assets, which are typically:

- Cash

- Land and property

- Cars and other assets used personally

- Loans to directors

- Passive investments.

The Equity Valuation then considers any financial debts and other liabilities the company may have to arrive at a valuation of the company’s shares.

Case Study: Valuing a Business vs the Company Shares

I have recently been asked to value a business for purposes of setting an appropriate sale asking price. Due to the diverse set of potential purchasers for the business, the owners were not sure if they were going to sell the business out of the company or sell the shares in the company themselves.

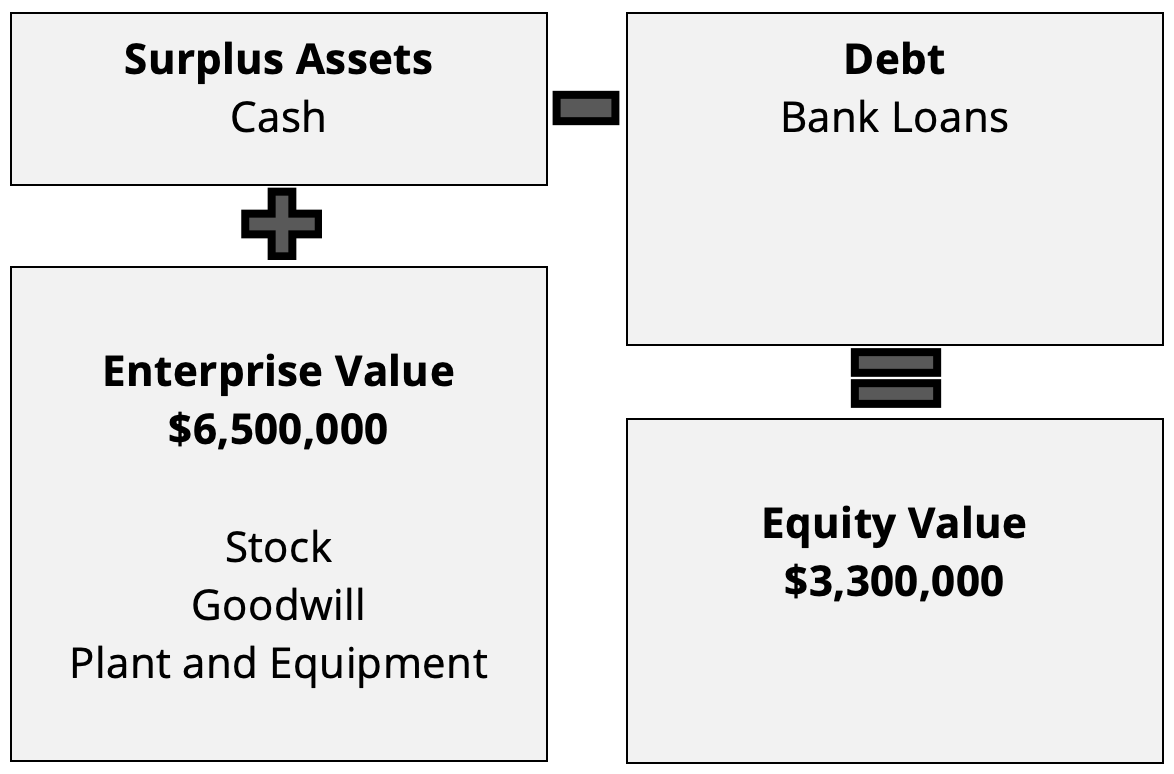

I worked with the owners to value the company’s assets and liabilities, resulting in valuations of:

- Stock: $500,000

- Goodwill: $2,000,000

- Plant and equipment: $4,000,000

- Cash: $300,000

- Bank loans: $3,500,000.

Based on my analysis, if they decided to sell the unencumbered business then $6,500,000 would be a reasonable sale price, but if the shares in the company were to be sold then $3,300,000 would be a reasonable sale price.

Using these valuations, we were able to advise the owners on the capital gains tax implications of selling the shares vs selling the business to maximise their post-tax sale proceeds. We also assisted the owners with preparing appropriate Expression of Interest documentation describing what was being offered for sale and targeting the potential purchasers most likely to offer the maximum purchase price.

How We Can Help

If you would like to talk to us about the value of your business or the valuation implications for an upcoming transaction, simply contact Tony Carter using the form below or by calling 02 4969 6600 and we can arrange a complimentary initial discussion.