The Costly Consequences Of Underinsurance In Commercial Property

Imagine this scenario: A severe fire breaks out in a commercial building, causing extensive damage. The property owner lodges a claim, only to receive devastating news – they’re underinsured. This situation is far more common than many realise. What many businesses and commercial property owners don’t understand is that the financial risks of underinsurance go […]

READ MORE2024 Year in Review

‘Twas the night before Christmas, and all through the house, Not a creature was stirring, not even the RBA mouse. While rate cuts abroad brought cheer and delight, Australia sat waiting, holding on tight. As we reflect on 2024, it’s clear the year was shaped by global events, economic resilience, and a series of milestones […]

READ MOREBuilding Wealth Through Investing in Property or Complementary Businesses for Your NDIS Business

Running a National Disability Insurance Scheme (NDIS) business is not just about delivering essential services; it’s also about creating a sustainable, fulfilling business, which helps to drive your personal goals. One strategic way to achieve this is by investing in property or businesses that complement your NDIS operations. The right investments can enhance your service […]

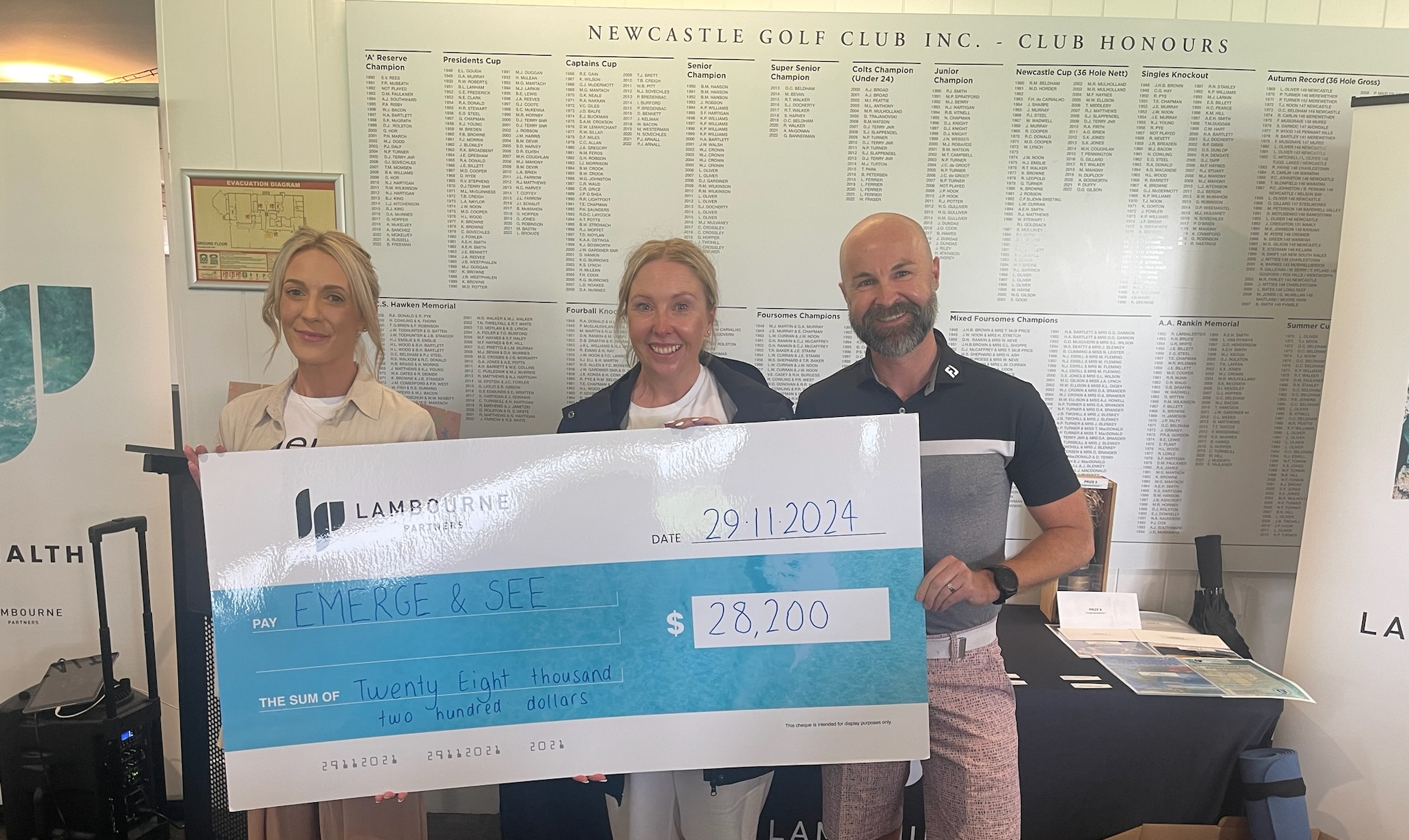

READ MORE2024 Lambourne Partners Annual Charity Golf Day

On Friday the 29th of November, we held the 13th annual Lambourne Partners Charity Golf Day at the Newcastle Golf Club. The event has raised $210,000 for local charities since 2011. This year our selected charity was Emerge & See. Emerge & See is an Australian-registered, not-for-profit, peer-led charity that supports, connects, educates, and empowers […]

READ MOREA Step Backwards: Lowering Standards in Financial Advice Puts Clients at Risk

As a financial adviser with over 15 years of experience, I’ve witnessed the financial advice profession undergo profound and necessary changes. These reforms, while challenging, were instrumental in raising the industry to a professional standard that inspires trust and delivers better client outcomes. However, the government’s constant tinkering with education and regulatory requirements risks undoing […]

READ MORE