2024 Australian Economic Forecasts For Businesses

Businesses are often not only affected by their own management decisions, but the wider trends of the economy, and conditions in their industry segment. Predicting the impacts of these broader economic factors is by no means an exact science, so here’s a summary of economic forecasting provided by Australia’s leading bodies including the Reserve Bank, […]

READ MOREConsulting Success Stories Of 2023

Across the past twelve months, Lambourne Partners Consulting has been fortunate to partner with our clients on their projects and developments across a diverse range of activities and industries. Despite the somewhat turbulent trading conditions, you as our clients have brought forward some of the most interesting, innovative, and impactful projects we have been involved […]

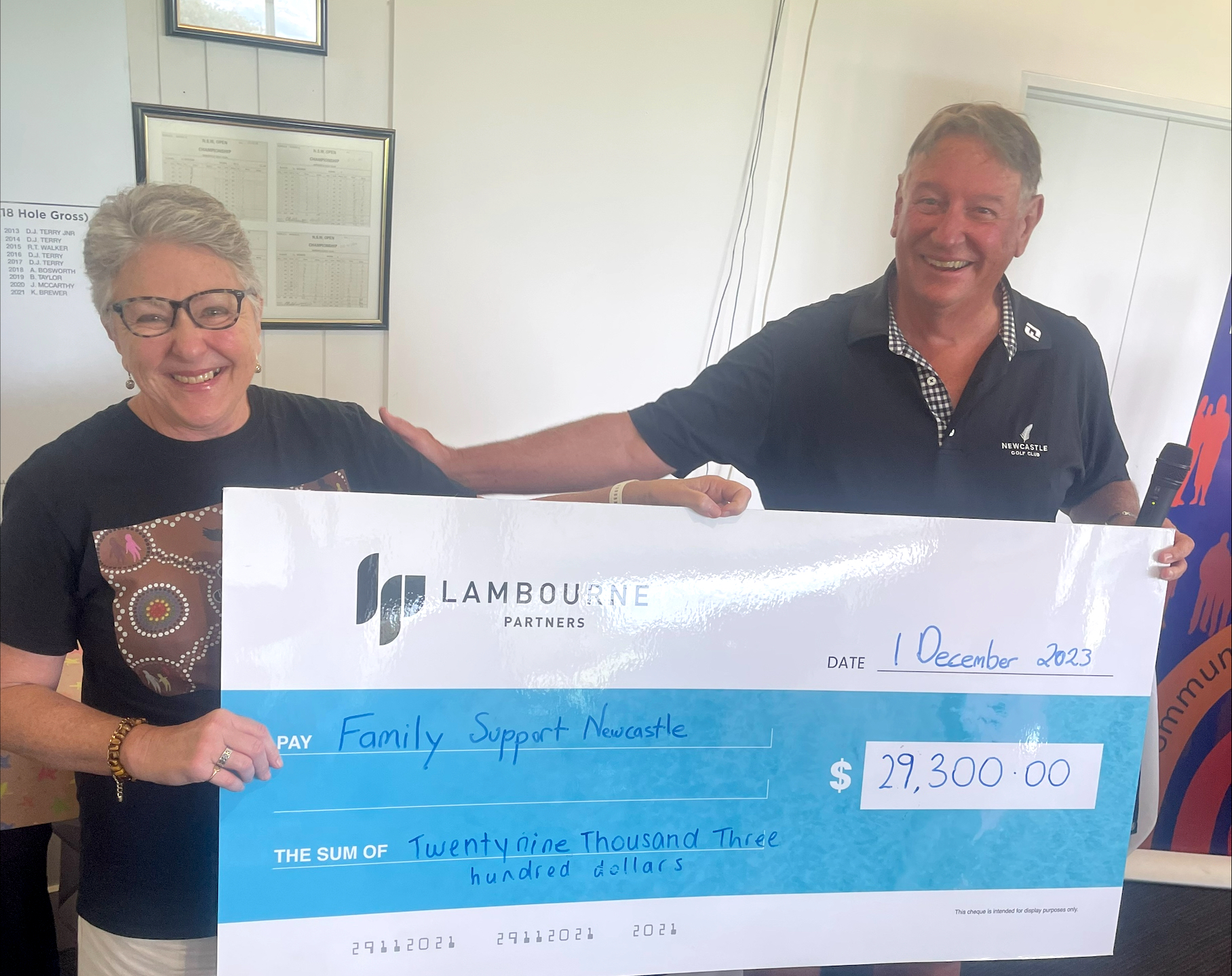

READ MORE2023 Lambourne Partners Annual Charity Golf Day

On Friday the 1st of December, we held the 12th annual Lambourne Partners Charity Golf Day at the Newcastle Golf Club in Fern Bay. The event has raised $180,000 for local charities since 2011. This year our selected charity was Family Support Newcastle (FSN). FSN recognises the isolation and challenges that men can face during times […]

READ MOREConsulting Case Study: Complex Business Modelling For Startup Funding

Our Consulting team‘s complex business modelling unlocks $21 million in funding for a tech & robotics startup. Background The technology & robotics company developed an innovative robot with the potential to transform the way mining activities are conducted in Australia. The Directors of the company had secured an in-principle agreement with a Tier 1 mining […]

READ MOREConsulting Case Study: Virtual CFO, Cash Flow Planning & Asset Rationalisation

Cash flow planning by our Consulting team and surplus asset sales clear $4 million in business purchase debt in a single year, saving over $500,000 in interest. Background After recently purchasing a successful business in the mining services industry, all key staff in the business continued their employment under the new company Director, with the […]

READ MORE