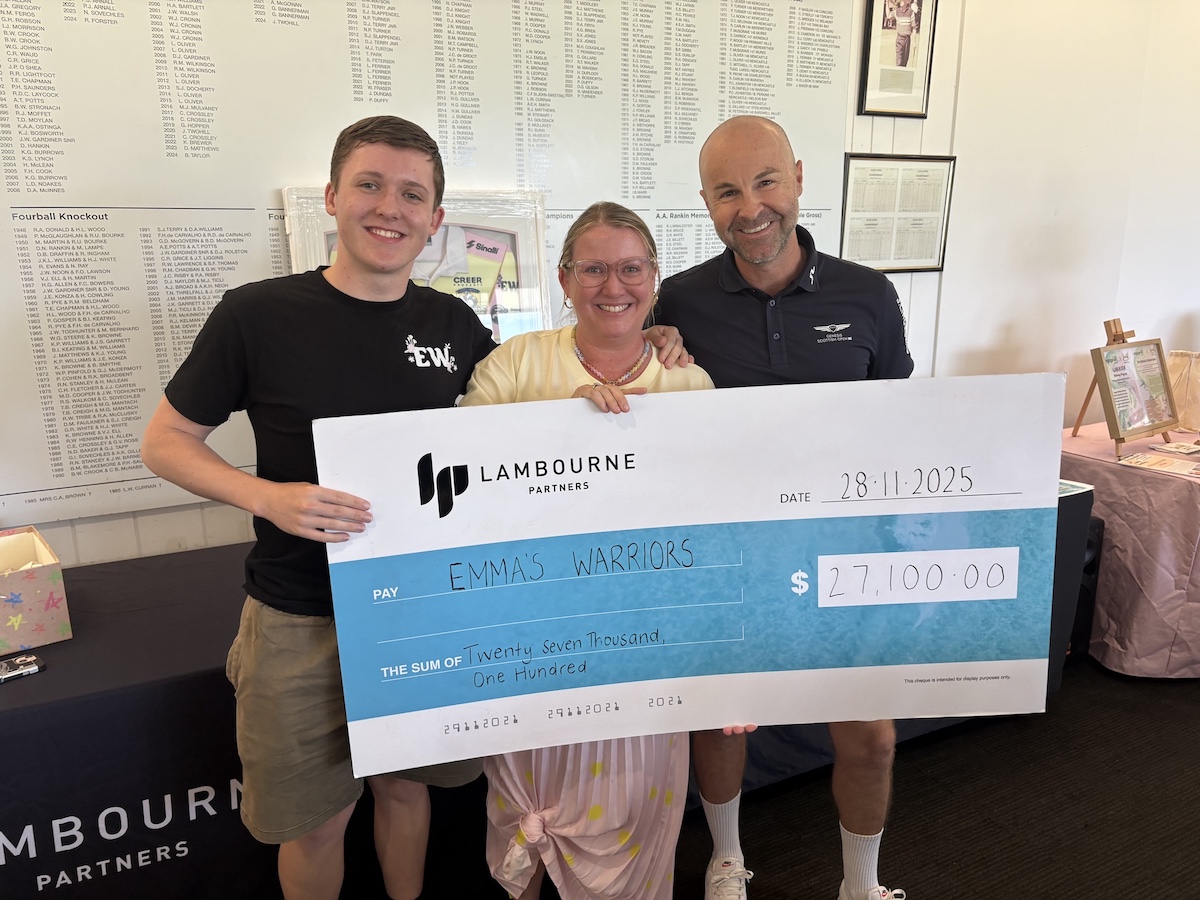

2025 Lambourne Partners Annual Charity Golf Day

On Friday the 28th of November, we held the 14th annual Lambourne Partners Charity Golf Day at the Newcastle Golf Club. The event has raised $240,000 for local charities since 2011. This year our selected charity was Emmas Warriors. Emma’s Warriors is dedicated to making life a little easier for children and families undergoing treatment […]

READ MOREUpdate On How Holiday Homes Are Treated For Tax Purposes

by Luke Quinnell Owning a holiday home that’s rented part-time and used personally offers flexibility and potential taxation benefits. Rental income can offset ownership costs, and legitimate deductions—such as interest, rates, and maintenance—may apply for income-producing periods. However, the ATO closely scrutinises these arrangements because mixed use often leads to inflated or incorrectly apportioned claims. […]

READ MOREUnderstanding the 6-Year Rule for the Main Residence Exemption from Capital Gains Tax

by Nick Allen For Australian tax residents, any gain on the disposal of your main residence is protected from capital gains tax. Simply put, the profit you make on the sale of your home is generally tax free. It is important to note that you can only have one main residence at a time, and […]

READ MOREUpdate On The Proposed Changes To The Tax On Super Balances Over $3million

by Luke Quinnell There has been a significant announcement today (13th October 2025) from the government regarding the proposed superannuation tax reforms on balances over $3million. The two most controversial aspects, being the taxing of unrealised gains and no indexation of the $3million threshold will both be removed. The original intent remains (i.e. to tax super […]

READ MOREDirectors’ Duties: Why Financial Oversight and Cash Flow Forecasting are Critical

Being a company director isn’t just about setting strategy and leading people — it also comes with significant legal responsibilities. One of the most important is making sure your company doesn’t trade while insolvent (that is, when it can’t pay its debts as they fall due). If a director allows this to happen, they could […]

READ MORE